Table of Content

As more consumers turn to online shopping for everyday items, Home Depot is losing ground when it comes to sales of cleaning products, home repair supplies, and other add-ons that people pick up while browsing the aisles. Stores have long relied on the unplanned purchases that shoppers make when they visit a Home Depot to keep sales figures high. Despite a strong history, Home Depot faces a certain level of risk, both in the short-term as well as the long-term. Quotes displayed in real-time or delayed by at least 15 minutes.

Stock prices are delayed, the delay can range from a few minutes to several hours. The Home Depot, Inc is an American home improvement chain based in Atlanta. It operates 2,284 DIY stores in North America and claims to be the largest DIY store chain in the world. Backlinks from other websites are the lifeblood of our site and a primary source of new traffic. Financhill just revealed its top stock for investors right now...

Benefits of a Home Depot Stock Split?

To further explore stock splits, please refer to Investopedia. Companies like Home Depot tend to split stocks after big gains to keep them affordable for smaller investors, though the underlying value doesn't change. It also helps make options cheaper and acts as a sort of first-down marker in the stock's appreciation, a signal the stock has achieved a significant advance and is ready for a reset.

In these cases it's best to contact your broker, to be clear on how they will handle the $HD shares split. As indicated by the Home Depot stock split history, the company bucked this tradition in favor of more complex ratios. Though Home Depot is a retailer, sales are closely correlated to the health of the housing market. As a result, when construction and renovation slowed in the latter half of 2018 due to a rise in interest rates, Home Depot saw lower sales. If you owned one share of Home Depot before its first stock split, you would now have 340 shares, worth more than $40,000. When they launched the company in 1978, Home Depot's founders followed a strategy popular among mass merchandisers today and offered a wide assortment of goods, low prices, and good customer service.

Will Home Depot Stock Split?

Overall, thanks to fractional share buying being common today, share prices have become less important in recent years. The underlying value of a company does not change when shares are split, thus investors don't have to worry about stock splits too much, anyways. It seems like management believes that there are no major advantages from stock splits for now, which is why the company ended its practice of splitting shares regularly about two decades ago. I do not believe that a stock split is overly likely in the near term, mainly due to the fact that I do not see a reason for management to suddenly change course.

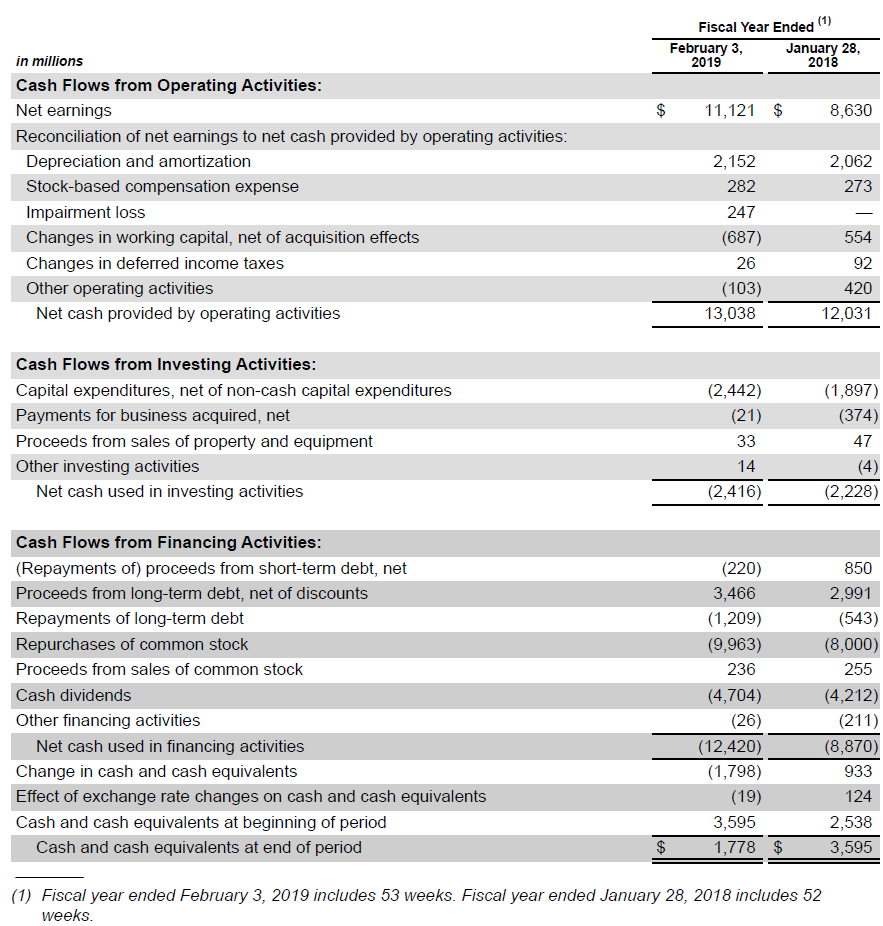

Depending on future earnings multiples and potential outperformance versus current expectations, returns could also be higher than that. Home Depot has, despite not opening a large number of new stores, managed to grow its sales and profits at an attractive pace in recent years. Same-store sales growth, combined with margin expansion thanks to operating leverage, resulted in ample profit growth. When we look at Home Depot's earnings per share growth, we see an even better performance, thanks to the impact of share repurchases that lowered the company's share count over the years. Between the growth of the stock price and the dividend increases, Home Depot has delivered incredible returns since its IPO. Instead of doing my own calculations, I turned to the company's website, which offers a handy calculator on its stock.

Stock splits for similar companies or competitors

In general, these companies try to keep their share prices in a range of $30-$100. As you can see from the chart, your share count would have increased by a factor of 342 if you bought Home Depot stock at its IPO and held it through 1999. But there's more to the return-on-investment picture than its share splits and stock price appreciation. The retailer has also been a generous dividend payer over much of its history.

But its above-average price per share might still result in a stock split in the future. A lower share price would also change Home Depot's weight in share-price weighted indices, such as the Dow Jones Industrial Average . Due to a high price per share, Home Depot has a pretty high weight in that index today, at 6%, making it one of the top 3 components of the 30-stock index.

Home Depot is simply packaging the number of outstanding shares in a different way. For example, in a 2-for-1 split, the amount of shares will double . Say you have 100 shares of Home Depot, then the day of the split you will receive 2 shares for every 1 share you hold in your brokerage account, meaning you will receive 200 shares on the stock split date. However, the price of the stock will reflect this change and your holding of Home Depot will remain practically the same. Since the last Home Depot split, there has been a general market-wide trend away from stock splits.

Second, when stock splits were popular, trades were made in 100-share lots. Keeping the per-share price below $100 allowed more investors to purchase the required 100 shares. More recently, the company has gotten back to aggressively raising its dividend. Earlier this year, it hiked its quarterly payout by 32% to $1.36 a share. Investors who bought this stock during the IPO and held on would be getting a split-adjusted return of more than 150 times on their investment from Home Depot annually just from the dividends. When the company first started paying a dividend, it was offering just fractions of a penny on a split-adjusted basis.

Overall, I think that the return outlook for Home Depot is attractive at current prices, but not outstanding. The lower valuation, despite slightly higher growth, is why I own Lowe's right now, but I think that opting for Home Depot - or going with both - is not at all a bad idea, either. Since growth will, due to the aforementioned law of large numbers, likely slow down eventually, it seems realistic to assume that Home Depot's earnings multiple could decline in coming years. If Home Depot were to trade at 20x net profits at the end of 2025, that would result in a share price of $412, which would equate to a 26% return from the current level, or about 6% a year. Add in Home Depot's dividend, and a high-single-digit return over the next couple of years seems highly realistic, I believe.

On Sept. 22, 1981, the company went public at $12 a share, or a split-adjusted price of just $0.03 a share, and by 1986 it had $1 billion in annual sales. This year, it's on track to generate more than $100 billion in high-margin revenue. Through strong execution, capital allocation, and thanks to business models that are not overly vulnerable versus online competitors, these companies thrived over the last couple of years. Home Depot has delivered a 10-year return of 900%, before dividends, and its 5-year return of more than 140% is pretty strong as well. Home Depot is a quality company with an attractive outlook, with or without a stock split. Some splits, like a 3-for-2 can result in shareholders owning fractional shares.

As for a future stock split, it looks like those days may be over. Following Nardelli's departure, Home Depot suffered through the recession and has been booming since. With shares now near $130, the stock is higher than at any point during its stock splits. DividendInvestor.com features a variety of tools, articles, and resources designed to help investors interested in dividend stocks find the best dividend stocks to buy. We provide opinion articles, detailed dividend data, history, and dates for every dividend stock, screening tools, and our exclusive dividend all star rankings. At $328, shares are currently offering a dividend yield of exactly 2.0%, while Home Depot's earnings multiple stands at 22.5 based on earnings per share estimates for the current year.

Strong leadership has allowed the business to ride out market highs and lows, resulting in quarterly earnings that have exceeded expectations for almost five years. The company was founded in Atlanta in 1978 by Bernie Marcus and Arthur Blank. After all, the #1 stock is the cream of the crop, even when markets crash. Buying now means you could be on board when values increase – and those who already have Home Depot shares would be wise to wait for a boost before considering a sale. This is consistent with Home Depot’s most recent moves that included a 2017 repurchase of $8 billion in stock.

Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services. I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article. Cold weather and economic uncertainty have impacted both the housing market and the retail industry, but there is every reason to believe that prices will perk up again.

So if you're holding CALLs or PUTs, the strike price of the $HD option will be automatically changed on the day of the split. So if you have a CALL in a 2-for-1, after split you will have 2 calls to control 200 shares, and the strike price of those two CALLs would be halved. These industry changes have reduced the pressure to split stocks, and Home Depot’s leadership has indicated a lack of interest in this strategy. While stock splits often result in a boost in positive sentiment, there is no intrinsic reward for investors.

No comments:

Post a Comment