Table of Content

Instead, Home Depot’s leadership stated that if and when it wants to create additional value for shareholders, it is more likely to look at repurchasing stock. First, several major players in the Dow Jones Industrial Average have allowed their prices to creep up – in some cases, close to $300 per share. While it's not a member of the Dividend Aristocrats -- that select group of companies that have raised their dividends every year for at least 25 years -- it nearly qualifies. Management has raised the dividend annually since 1987 with the exceptions of 2007, 2008 and 2009, when it took a pause during the housing bust. Let's take a look back at Home Depot's stock history to find out how much you'd have today if you had invested $1,000 at its IPO. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

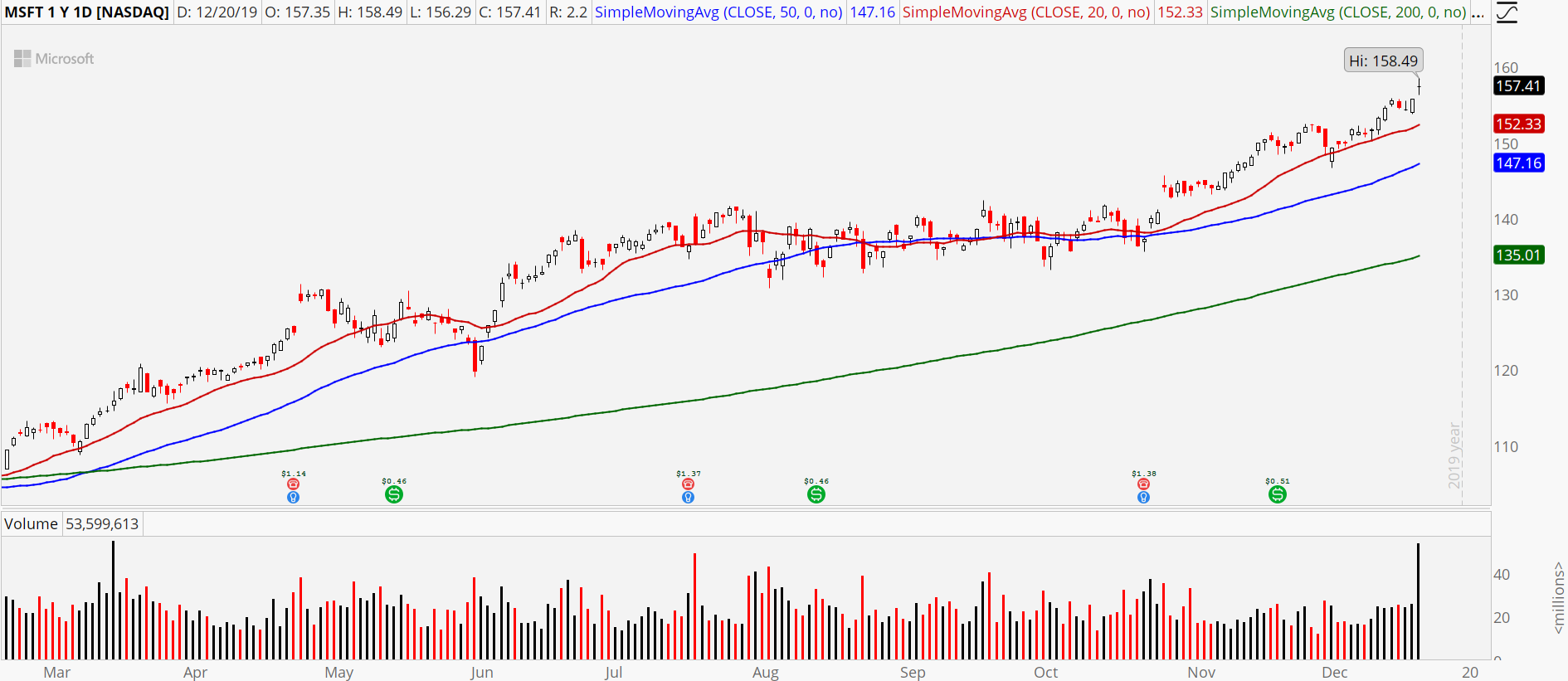

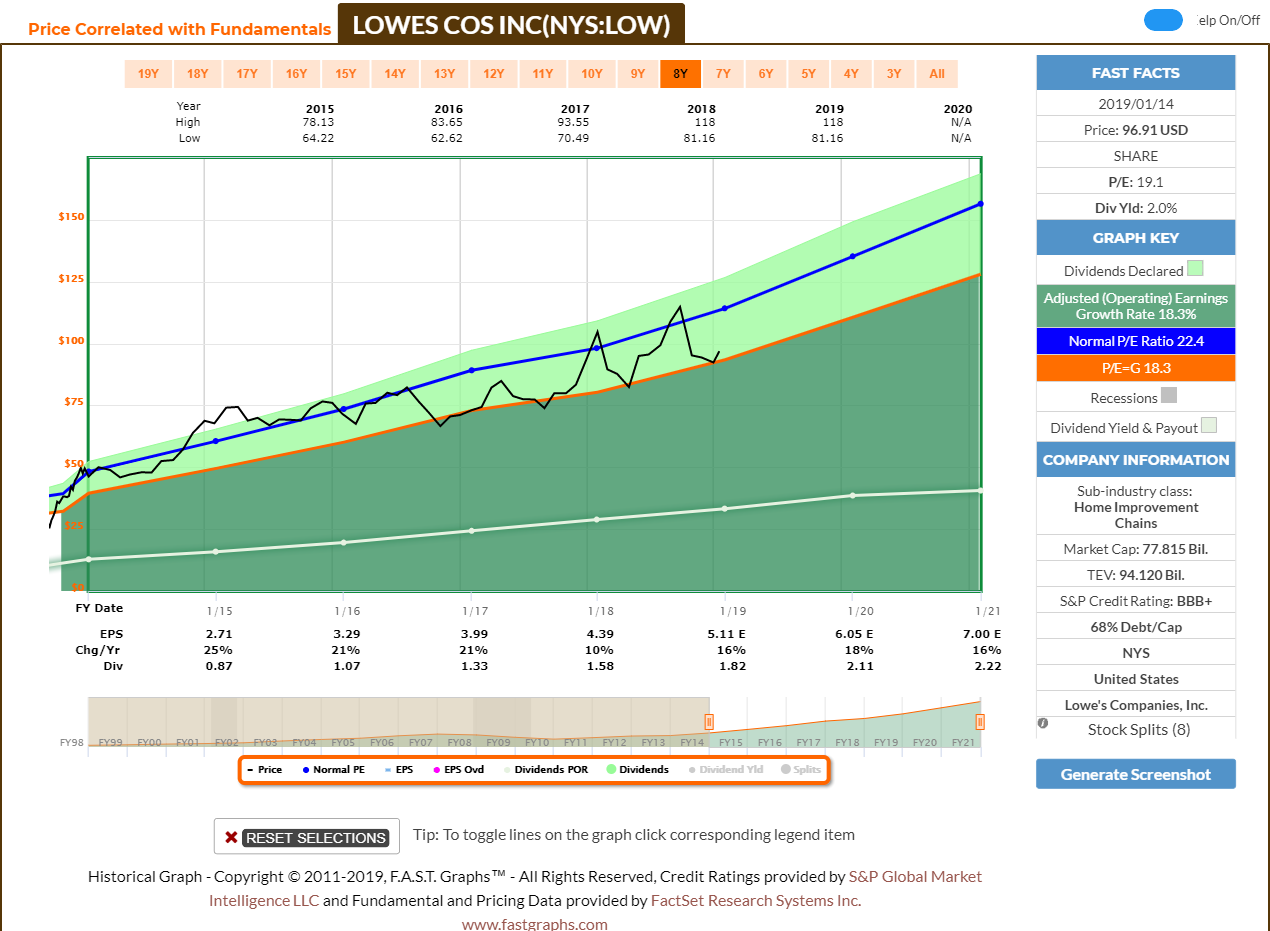

Its first stores in the Atlanta area were significantly bigger than those of its competitors, which helped drive the company's initial momentum and positioned its brand as a one-stop-shop for home improvement. I/we have a beneficial long position in the shares of LOW, MSFT, AMZN either through stock ownership, options, or other derivatives. The company's shares are trading higher than they traded when management decided to split them in the past. While this is not financial advice and we have not run any thorough studies on the matter, general consensus is that price tends to go up after the announcement of a stock split and before the stock split itself happens. In the meantime, investors can enjoy reliableHome Depot stock dividends, which have increased steadily every year. However, Home Depot has never relied on market norms to make this decision, and it didn’t split its stock in 2018.

Split History

According to the company, the stock's total return, which includes reinvested dividends, is 1,153,940% (a 27.7% annualized return). Of that, 713,000% comes from share appreciation while 440,000% is from dividend payouts. In the case of a 2-for-1, the strike price of all the options chain post-split will be divided by 2 automatically.

Based on those numbers, if you had invested $1,000 in Home Depot's IPO and reinvested the dividends, you would have approximately $11.5 million today. Because of inflation, your actual buying power would be more equivalent to $4.07 million in 1981 dollars. However, there's no denying that those are mind-boggling returns that underscore the remarkable power of compound growth.

How Does a Home Depot Share Split Work?

On Sept. 22, 1981, the company went public at $12 a share, or a split-adjusted price of just $0.03 a share, and by 1986 it had $1 billion in annual sales. This year, it's on track to generate more than $100 billion in high-margin revenue. Through strong execution, capital allocation, and thanks to business models that are not overly vulnerable versus online competitors, these companies thrived over the last couple of years. Home Depot has delivered a 10-year return of 900%, before dividends, and its 5-year return of more than 140% is pretty strong as well. Home Depot is a quality company with an attractive outlook, with or without a stock split. Some splits, like a 3-for-2 can result in shareholders owning fractional shares.

To further explore stock splits, please refer to Investopedia. Companies like Home Depot tend to split stocks after big gains to keep them affordable for smaller investors, though the underlying value doesn't change. It also helps make options cheaper and acts as a sort of first-down marker in the stock's appreciation, a signal the stock has achieved a significant advance and is ready for a reset.

Investing

Historically, most companies have chosen a two-for-one split around the $100 mark to manage pricing and reward investors. Nonetheless, many analysts suggest that now is the time to buy Home Depot stock. It can be had for a relative bargain, and there are some indications that it may be headed for a rally. As a retailer, Home Depot is not immune from the pressures of the growing trend towards e-commerce.

In these cases it's best to contact your broker, to be clear on how they will handle the $HD shares split. As indicated by the Home Depot stock split history, the company bucked this tradition in favor of more complex ratios. Though Home Depot is a retailer, sales are closely correlated to the health of the housing market. As a result, when construction and renovation slowed in the latter half of 2018 due to a rise in interest rates, Home Depot saw lower sales. If you owned one share of Home Depot before its first stock split, you would now have 340 shares, worth more than $40,000. When they launched the company in 1978, Home Depot's founders followed a strategy popular among mass merchandisers today and offered a wide assortment of goods, low prices, and good customer service.

How Does a Stock Split Affect $HD Options?

At the IPO, $1,000 would have allowed you to purchase roughly 83 shares of stock. Home Depot has split its stock 13 times over the course of its history, though those splits came mostly in its early days as a publicly traded company and its last split came in 1999. The chart below shows each split, along with how it drove increases in shareholder value.

Essentially, the company has split its shares every one and a half years or so during the 1980s and 1990s, a time during which Home Depot experienced rapid earnings growth and strong share price gains. Back then, when fractional share buying was not available through most brokers, the price per share mattered a lot more compared to today, when most investors can buy fractions of a share easily. Splitting shares regularly thus made sense for Home Depot, as the company could thereby keep its share price in a desired range. A stock split does not change the fundamental value of a company. Meaning a Home Depot stock split will not make the business more valuable. However, there is a psychological benefit in that the share price will be lower after the split, making shares seem more accessible to everyone and thus temporarily increasing demand and ramping up share prices.

While shareholders sometimes fixate on a split, it adds no value for investors. The market capitalization sometimes referred as Marketcap, is the value of a publicly listed company. In most cases it can be easily calculated by multiplying the share price with the amount of outstanding shares.

The chart below helps explain why the stock hasn't split in 17 years. The Home Depot 52-week low stock price is 264.51, which is 18.2% below the current share price. The Home Depot 52-week high stock price is 417.84, which is 29.2% above the current share price. Home Depot has delivered attractive gains of more than 20% so far this year, but in recent months, shares have mostly moved sideways. A Home Depot stock split is no different than any other stock split.

HDThe current slump in share prices is good news for those who are thinking of purchasing Home Depot stock now. Home Depot’s intention behind the splits doesn’t appear to be an effort to keep share prices below $100, because in many cases, the splits occurred when share prices were already affordable. Home Depot investors would be better off following the company's progress to those goals than rooting for a stock split. If the company can meet those targets, the stock should continue to rise along with its dividends.

As you can see, the stock surged from its IPO in 1981 to the end of the tech boom in 1999. From then the stock moved sideways under the misguided leadership of Bob Nardelli. Nardelli ran the home-improvement retailer from December 2000 to January 2007. Despite presiding over the company during the biggest housing boom in modern history, the stock lost 8% during his tenure, while shares of rivalLowe'smore than tripled during that period. Home Depot's success story shows the immense rewards that can be reaped by investing early in a great company and holding the stock for a long time. Even a small initial investment can make you a millionaire several times over if your timing and stock picks are right.

In general, these companies try to keep their share prices in a range of $30-$100. As you can see from the chart, your share count would have increased by a factor of 342 if you bought Home Depot stock at its IPO and held it through 1999. But there's more to the return-on-investment picture than its share splits and stock price appreciation. The retailer has also been a generous dividend payer over much of its history.

No comments:

Post a Comment